Unpaid rent

Up to 12 months’ unpaid rent

mozaïk offers custom insurance for home owners looking to rent their properties with total peace of mind. Foyer offers cover to protect your investment and keep unforeseen events from affecting your income!

income

Your cover

You have essential guarantees to protect your rental property.

Building owner third-party liability

This special insurance covers you for damage caused to third parties by maintenance, repair and renovation works.

Rent reimbursement

What if your tenant stops paying rent? We will cover your rent and utilities for 12 months. It won’t affect you at all!

Legal cover for unpaid rent

We take care of legal and extra-legal fees related to unpaid rent and even eviction costs.

Damage caused by tenants

Some damage is covered by tenant’s insurance, but mozaïk covers the cost (up to six months’ rent) of restoring your property in the event you notice damage caused by the tenant during the final status report when they are moving out.

Eco-energy cover

Your renewable energy installations such as geothermal, hydroelectric, wind turbine, solar panel, heat pump, biomass, condensing boiler and micro CHP boiler systems are insured for breakage and construction defects. We also cover loss of electricity production.

Building owner legal expenses

In the event of a dispute with a tenant, professional or service provider, we help you through the process and cover the cost of your legal, expert’s and bailiff’s fees.

Your advantages

24/7 assistance

We will immediately send a professional to handle emergency heating breakdowns, water leaks, blocked pipes, etc.

Simplicity

All of your property covered under a single policy.

Personalised advice

You need to be reassured and advised in difficult times. That’s why our network of agents is here for you.

Portable heaters: beware of fire!

Portable heaters are very effective at quickly heating up a room and are very useful in a bathroom, guest room or office, especially when working from home. Whether it’s electric,…

Read more : Portable heaters: beware of fire!Expats: plan your trips with peace of mind with the right insurance

Whether you are visiting loved ones, discovering a new destination or simply taking a break, it is essential to prepare your trips well. And that includes taking out the right…

Read more : Expats: plan your trips with peace of mind with the right insuranceTips for a cosy and safe Christmas

Christmas is approaching and all the decorations have been brought up from the cellar and down from the attic. Christmas trees, mantels and window sills are probably covered with glitter…

Read more : Tips for a cosy and safe ChristmasFind all our advice on the blog

You can discover all our articles written by experts to help you understand the world of insurance, give you the best advice and above all, help you prevent risks in your everyday life.

The insurance check-up, the central instrument of our advisory approach

As an insurer, our role is to guide you towards the type of coverage most suited to your daily activities so that you feel fully protected.

To help everyone clarify their situation, we have developed what we call the “customer assessment“. It’s a simple, intuitive tool that provides an overview of your insurance needs, defines your priority requirements and your medium- and long-term prospects, and guides you towards a personalised solution.

To take advantage of this service, just make an appointment with a Foyer agent, it’s free and with no obligation.

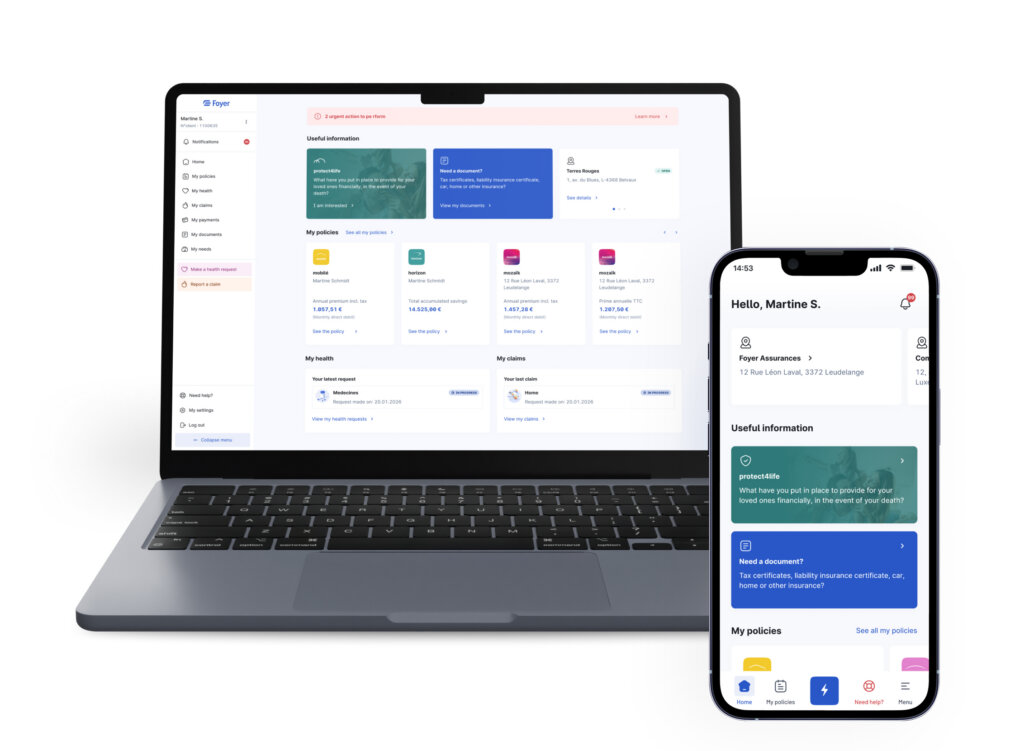

MYFOYER APP

Simple and intuitive, MyFoyer makes your online procedures easier

Submit your health and claims requests online

Save time and complete your procedures in your Client Area.

Sign your documents remotely

You can sign your contracts and direct debit authorisations from home.

Real-time tracking

No more waiting around, you can keep track of the progress of your files.

Access your documents

View and download all your important documents.

Manage your profile

Update your personal data yourself.

View and pay your invoices

View and pay your invoices online.

Contact me

Contact our experts and we will provide you with a quick response.