Motorcycle insurance

Motorcycle insurance for safe riding

On two wheels, you need to be extra vigilant! Choose comprehensive motorcycle insurance and ride with peace of mind.

Protect yourself and your motorcycle

Are you a motorcycle enthusiast, do you love fine mechanical engineering, or do you simply love travelling on our beautiful roads?

No matter how you express your passion on the road, motorcycle insurance is essential to protect you and your vehicle. As motorcyclists and bikers are more exposed to other road users on the road, Foyer offers you extended, all-inclusive cover with mobilé.

Protected drivers and riders

Drivers and riders are typically the only ones not compensated for their own damage in the event of an accident. To address this shortfall, we are offering you this personal cover for yourself (and all other drivers named in the policy), for all your journeys, in the event of injury or disability, whether you are riding your motorcycle, on your bike, on a scooter or on public transport. We compensate your beneficiaries in the event of death.

our services

Benefit from the best motorcycle insurance

Quality of service

98% of claims settled with just one call.

Real-time follow-up

Tracking of the progress of your claims in your Client Area.

Keeping personal belongings safe

Your equipment and luggage benefit from extensive protection.

Motorcycle insurance cover

You have essential cover to protect yourself when motorcycling.

Motorcycle insurance options

Foyer offers you six options to choose from to supplement your motorcycle insurance.

If you make a claim

We offer you services to simplify your life.

Claim declaration

From the place of the accident or at your home, by telephone, email or via the MyFoyer app.

Up-to-date information

Follow the progress of your vehicle claims in real time and the different steps in just a few clicks.

Do you own a car?

We’re there to protect you. Whether you are on two wheels or four, discover our mobilé car insurance policy that covers you, your passengers and your vehicle.

Simulate your mobilé car insurance online and find the best cover!

Charging your car at home: what you need to know

Choosing an electric car also means making choices about how you recharge it. Can you install a charging point at your home? Which one should you choose? How much power? How much will it cost? How do you control access? These are just some of the questions we’ll try to answer in this article.

Charging your electric car is getting easier in Luxembourg!

Although electric cars are becoming more popular, many Luxembourgers are still hesitant to get one. This is due to the specifics of charging vehicles, the availability of charging points, the charging time, concerns about breakdowns, etc. However, several recent developments should help to reassure those who are undecided. Let’s take a closer look at the subject.

Which electric car to choose in 2024?

In 2023, nearly one in four cars registered in Luxembourg was electric, not counting plug-in hybrids. From Dacia and Ferrari to Suzuki and Volvo, all manufacturers are involved in electric vehicles. So, at the same range level, manufacturers now have to set themselves apart on aspects other than power or engine reliability, both of which are excellent in electric vehicles. The new selection criteria are load capacity and speed. We help you decide how to choose an electric car in 2024.

Foyer blog

Find all our advice on the blog

You can discover all our articles written by experts to help you understand the world of insurance, give you the best advice and above all, help you prevent risks in your everyday life.

The insurance check-up, the central instrument of our advisory approach

As an insurer, our role is to guide you towards the type of coverage most suited to your daily activities so that you feel fully protected.

To help everyone clarify their situation, we have developed what we call the “customer assessment“. It’s a simple, intuitive tool that provides an overview of your insurance needs, defines your priority requirements and your medium- and long-term prospects, and guides you towards a personalised solution.

To take advantage of this service, just make an appointment with a Foyer agent, it’s free and with no obligation.

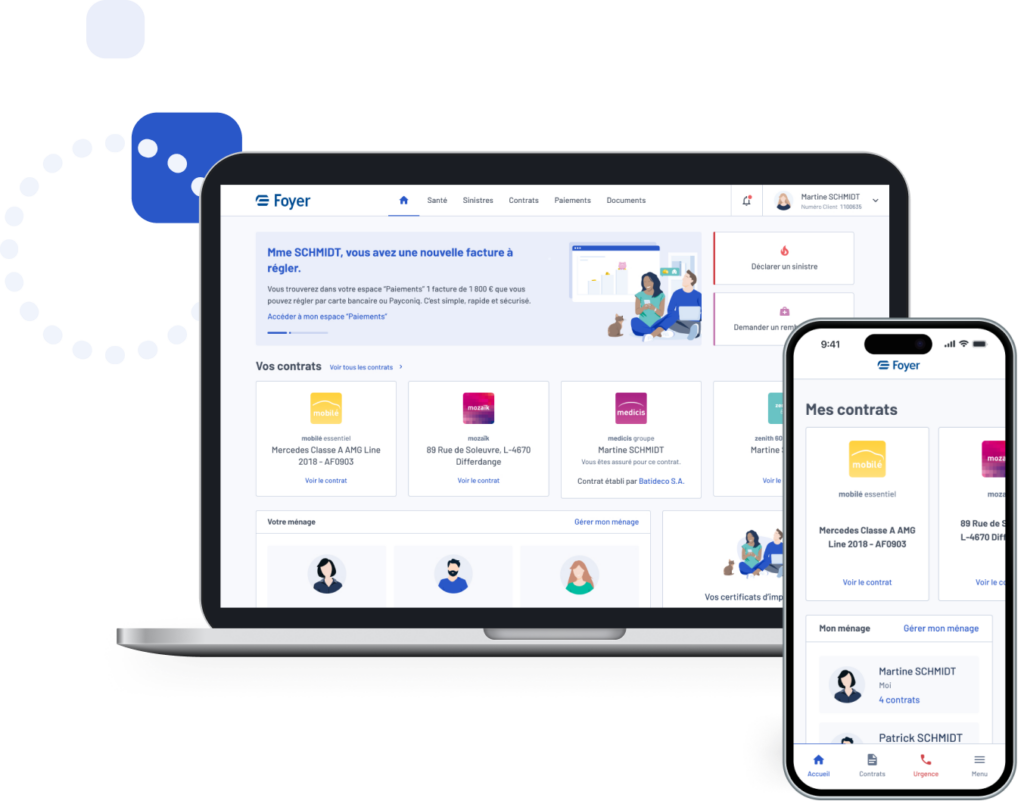

MyFoyer Client Area

In your myFoyer client area, you can view your contracts, request a tax certificate or update your personal details.

Contact me

Contact our experts and we will provide you with a quick response.