Home insurance & general cover

Insure your home and your everyday life

Whether you’re an adventurer, a home lover, a sports enthusiast, a collector, an investor or just someone looking for the perfect home, your lifestyle is unique to you.

estate income

Our tailored solutions for your home and your everyday life

Discover our customisable solutions to suit all your home and everyday insurance needs.

Home insurance

Protect your home, your possessions and your family against everyday risks. Tailored guarantees for optimal security.

Rental protection

Protect your real estate investments. Thanks to mozaïk, your income and any damage caused by your tenants are insured.

Travel insurance

Set off with peace of mind! Medical, cancellation, luggage cover… We’ll be by your side on all your adventures.

Outstanding balance insurance

Secure your mortgage and protect your loved ones by leaving no major financial burden in the event of a life event.

Valuables

Whether you are an amateur or art collector, protect the unique character of your valuables with Fine Art by Hiscox.

Moving house

Move into your new home. We can help you move in with peace of mind.

Mortgage

Find the best interest rate for your future real estate purchase. Our team of mortgage experts helps you find the best financing to make your acquisition project reality.

Calculate the cost of your insurance

- Do you live in an apartment?

In just three clicks, find out the price of your home insurance and select the options that suit you. - Do you live in a house?

Your insurance needs require the expertise of an agent to provide you with the best cover. We invite you to contact a Foyer agent or leave us your details and we will contact you.

Portable heaters: beware of fire!

Portable heaters are very effective at quickly heating up a room and are very useful in a bathroom, guest room or office, especially when working from home. Whether it’s electric,…

Read more : Portable heaters: beware of fire!Expats: plan your trips with peace of mind with the right insurance

Whether you are visiting loved ones, discovering a new destination or simply taking a break, it is essential to prepare your trips well. And that includes taking out the right…

Read more : Expats: plan your trips with peace of mind with the right insuranceTips for a cosy and safe Christmas

Christmas is approaching and all the decorations have been brought up from the cellar and down from the attic. Christmas trees, mantels and window sills are probably covered with glitter…

Read more : Tips for a cosy and safe ChristmasFind all our advice on the blog

You can discover all our articles written by experts to help you understand the world of insurance, give you the best advice and above all, help you prevent risks in your everyday life.

The insurance check-up, the central instrument of our advisory approach

As an insurer, our role is to guide you towards the type of coverage most suited to your daily activities so that you feel fully protected.

To help everyone clarify their situation, we have developed what we call the “customer assessment“. It’s a simple, intuitive tool that provides an overview of your insurance needs, defines your priority requirements and your medium- and long-term prospects, and guides you towards a personalised solution.

To take advantage of this service, just make an appointment with a Foyer agent, it’s free and with no obligation.

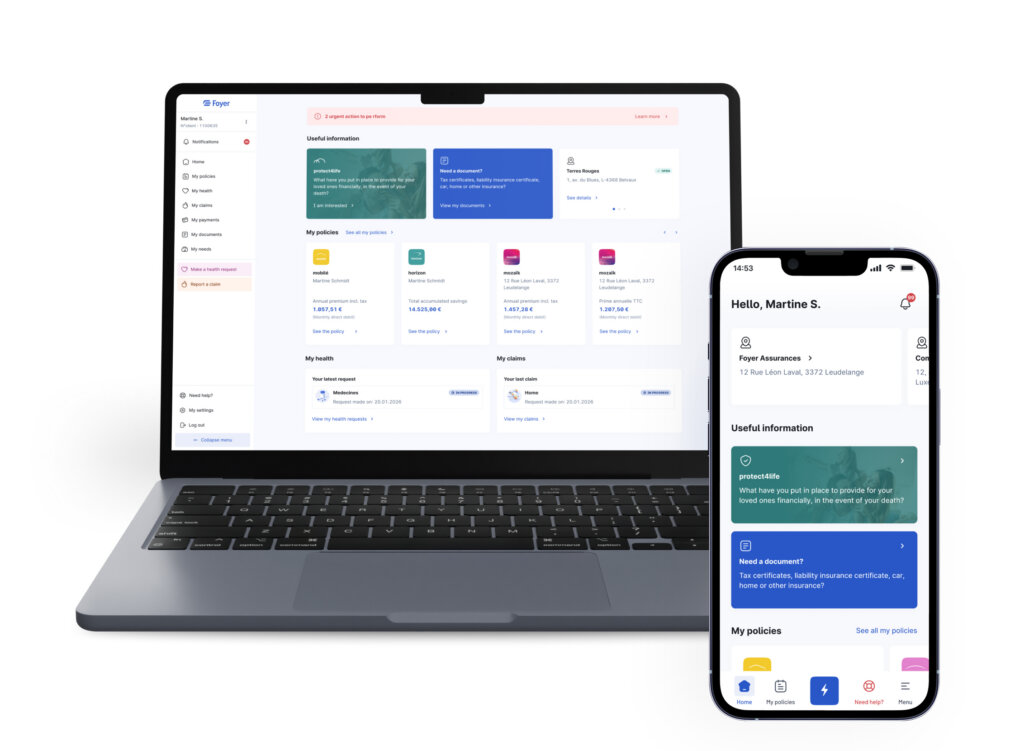

MYFOYER APP

Simple and intuitive, MyFoyer makes your online procedures easier

Submit your health and claims requests online

Save time and complete your procedures in your Client Area.

Sign your documents remotely

You can sign your contracts and direct debit authorisations from home.

Real-time tracking

No more waiting around, you can keep track of the progress of your files.

Access your documents

View and download all your important documents.

Manage your profile

Update your personal data yourself.

View and pay your invoices

View and pay your invoices online.

Contactez-nous

Contact our experts and we will provide you with a quick response.