Travel insurance

Travel insurance to cover the unexpected

Whether your keen on visiting faraway places or taking relaxing trips with your family, your holidays are special. Don’t let the unforeseen ruin them. With travel insurance, Foyer protects you and your family during your holidays.

Choose one of three solutions of travel insurance to meet your needs, whether you’re travelling alone, with another person or as a family

The module Travel

the mozaïk cover option

The most comprehensive cover. As a thank you for your loyalty, we can offer you a greater level of cover.

Occasional trips

All-in-one cover

Is this a special trip? Will you be travelling around the world? We can offer you bespoke solutions.

Annual policy

For your regular trips

The perfect package for frequent travellers.

Your cover

Take advantage of essential guarantees to travel with complete peace of mind.

Cancellation insurance

What if you go through hard times, your passport is stolen or you experience health issues? Cancellation cover of our travel insurance means you don’t need to worry about any last-minute surprises and can book your next trip ahead of time with peace of mind.

Cover for medical costs

In the event you get ill or are involved in an accident, we cover any medical costs that the social security doesn’t cover up to €125,000 for separate policies or up to €1,000,000 if you select the option as part of your mozaïk policy.

Luggage cover

Your luggage is insured if it gets lost, stolen or damaged for up to €5,000 or even to up to €7,500 if you select the option as part of your mozaïk policy. Your cash and valuables are also covered for theft.

24/7 assistance

A small issue can quickly turn into a big problem when you’re abroad. No matter the time or place, you can always count on us. In partnership with Europ Assistance, Foyer Luxembourg offers you assistance around the clock, 24/7.

Your mortgage broker: an expert by your side

Using a mortgage broker is invaluable at a time when interest rates are volatile. They’ll guide you through the mortgage application process from analysing your finances to when you sign…

Read more : Your mortgage broker: an expert by your side6 mistakes to avoid when taking out a home insurance policy

In 2020, the Grand Duchy had about 265,000 households, including over 170,000 owner-occupiers. Home insurance isn’t a legal requirement in Luxembourg, but is nonetheless highly recommended. Tenants will often find…

Read more : 6 mistakes to avoid when taking out a home insurance policyLearning Luxembourgish: a step-by-step language-learning guide

Luxembourg is a real melting pot with expats making up 47.3% of its population! While English, French and German are widely spoken, Luxembourgish remains the national language. Whether you have…

Read more : Learning Luxembourgish: a step-by-step language-learning guideFind all our advice on the blog

You can discover all our articles written by experts to help you understand the world of insurance, give you the best advice and above all, help you prevent risks in your everyday life.

The insurance check-up, the central instrument of our advisory approach

As an insurer, our role is to guide you towards the type of coverage most suited to your daily activities so that you feel fully protected.

To help everyone clarify their situation, we have developed what we call the “customer assessment“. It’s a simple, intuitive tool that provides an overview of your insurance needs, defines your priority requirements and your medium- and long-term prospects, and guides you towards a personalised solution.

To take advantage of this service, just make an appointment with a Foyer agent, it’s free and with no obligation.

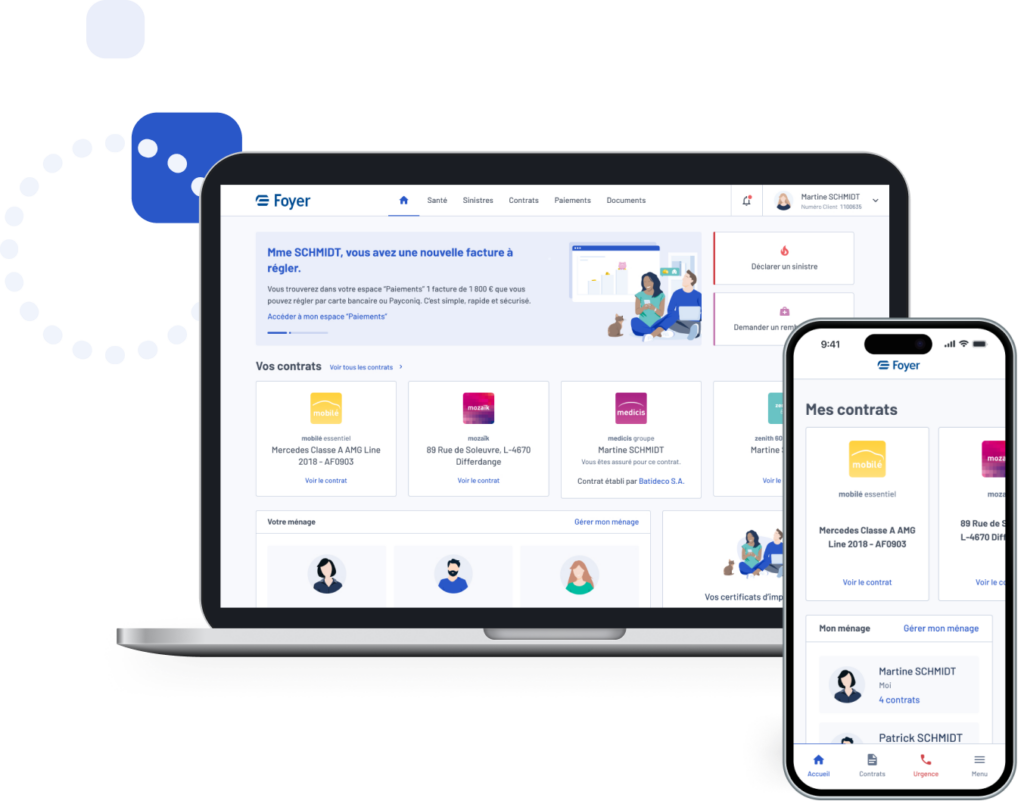

MyFoyer Client Area

In your MyFoyer client area, you can view your contracts, request a tax certificate or update your personal details.

Contact me

Contact our experts and we will provide you with a quick response.

More info

In case of a temporary travel insurance, the subscription of the contract within 3 days of the booking is mandatory.