Life insurance

Life insurance to protect you and your loved ones

Protect your family’s future while optimising the taxation of your savings with our life insurance products. The key to a secure financial future!

my savings

my retirement

my family

Our SOLUTIONS

Find out more about Foyer life insurance tailored to your needs

You can’t predict what life will throw at you, but you can anticipate the risks and secure your financial future and that of your loved ones. With our life insurance policies, you can protect your family, build up your supplementary pension, save for your plans or your children, or grow your capital.

Retirement savings solutions

Supplementary pension insurance allows you to build up savings to supplement your statutory pension and maintain your purchasing power.

With horizon, you prepare for your retirement while taking advantage of stock market opportunities.

Personal protection

Personal protection insurance will protect you against what life throws at you: illness, disability or death, and ensure the payment of a lump sum or annuity to your loved ones.

If you want to protect your loved ones, your income and regularly save for your plans or children, our protect4life solution combines all three while optimising your taxes.

Investment savings

Investment insurance allows you to invest your money in order to make it grow. It will also help you build your future and that of your loved ones by ensuring the transfer of your assets with full confidence.

With our investment solutions, you can build up capital and make it grow by benefiting from stock market returns.

Mortgage loan cover

Temporary outstanding balance insurance enables you to guarantee repayment of your mortgage in the face of events that could affect your financial capacity.

Our focus investissement solution gives you peace of mind by covering your loan, while protecting your loved ones from any major financial burden in the event of a life event.

Do you want to optimise your taxes?

Some insurance premiums are deductible expenses that can be claimed on your tax return to reduce your tax bill.

Invest in your plans

Do you have lots of ideas for the future? Do you dream of buying a country house, sailing around the world, building a veranda or helping your children or grandchildren…

Read more : Invest in your plansInsurance premiums that can be deducted when you file your Luxembourg tax return

Luxembourg’s tax system offers ways to reduce your income tax liability thanks to deductible insurance premiums. Article 111bis of the individual tax allowances (ITA)[1] allows you to deduct up to…

Read more : Insurance premiums that can be deducted when you file your Luxembourg tax returnCompleting your Luxembourg tax return: hints and tips

Most Luxembourg citizens and cross-border workers must complete a tax declaration in Luxembourg every year. The declaration gives you the opportunity to deduct various expenses and so reduce the amount…

Read more : Completing your Luxembourg tax return: hints and tipsFind all our advice on the blog

You can discover all our articles written by experts to help you understand the world of insurance, give you the best advice and above all, help you prevent risks in your everyday life.

The insurance check-up, the central instrument of our advisory approach

As an insurer, our role is to guide you towards the type of coverage most suited to your daily activities so that you feel fully protected.

To help everyone clarify their situation, we have developed what we call the “customer assessment“. It’s a simple, intuitive tool that provides an overview of your insurance needs, defines your priority requirements and your medium- and long-term prospects, and guides you towards a personalised solution.

To take advantage of this service, just make an appointment with a Foyer agent, it’s free and with no obligation.

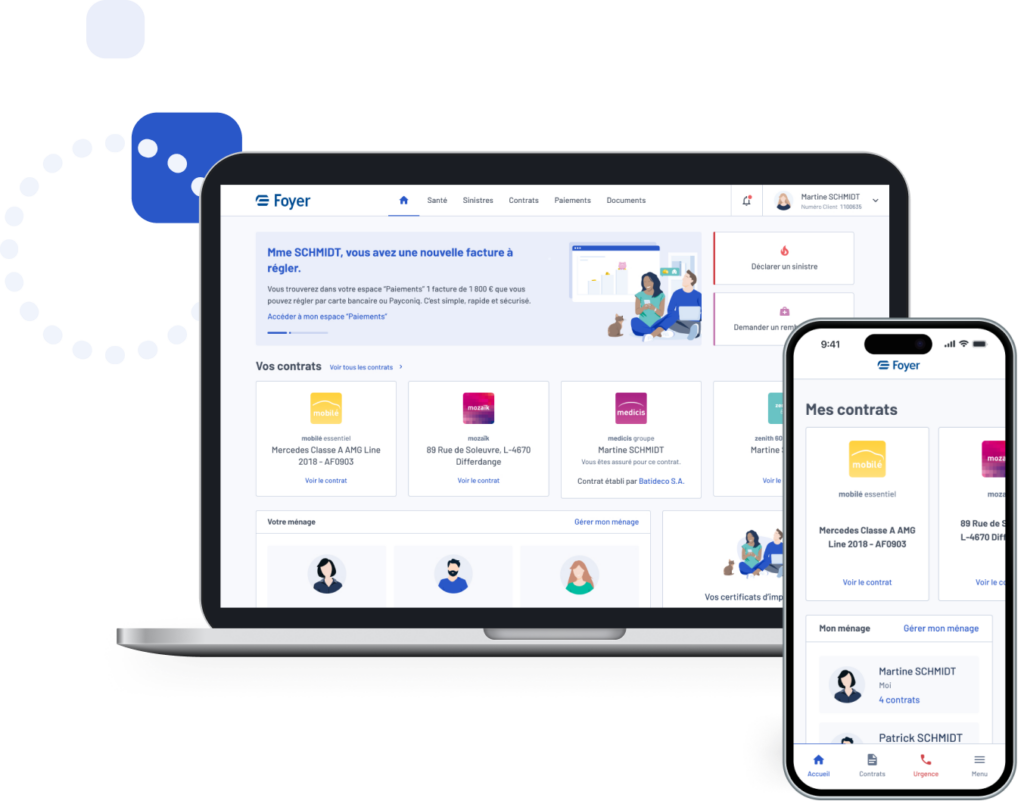

MyFoyer Client Area

In your MyFoyer client area, you can view your contracts, request a tax certificate or update your personal details.

Contact me

Contact our experts and we will provide you with a quick response.