Retirement

Prepare for your retirement in a flexible way

horizon is a supplementary pension plan that allows you to build up a pension while taking advantage of stock market opportunities. Your payments are invested in investment funds. These funds are managed daily by our CapitalatWork specialists according to your investor profile.

for my retirement

Key features

Tax optimisation

Under the terms to articles 111bis of the Income Tax Law, it is possible to deduct from your taxable amount the premiums paid under a life insurance policy. You can deduct up to €4,500 a year under your horizon policy.

Our SOLUTIONS

The choice of different investment vehicles to allocate your savings

1 capital protection option to provide balance between growth and security.

(Within the limit of 50% of your investments)

6 variable capital investment vehicles that offer greater performance, including 2 ESG vehicles to give meaning to your investments by adopting a responsible approach.

Conditions:

- The minimum contract term is 10 years.

- The contract maturity age is minimum 60 years and maximum 75 years.

Access to different unit-linked investment vehicles

To benefit from interesting yield prospects, you also have access to different funds.

They enable you to invest according to your investment horizon and your risk profile.

| Currency | Date | NAV | YTD | 1 year | 3 years | 5 years | ||

|---|---|---|---|---|---|---|---|---|

| ESG Bonds at Work | CurrencyEUR | Date11/02/2026 | NAV156.46 | YTD1.36 % | 1 year-0.06 % | 3 years1.59 % | 5 years0.19 % | Download details |

| ESG Equities at Work | CurrencyEUR | Date11/02/2026 | NAV266.53 | YTD1.78 % | 1 year9.16 % | 3 years11.79 % | 5 years9.06 % | Download details |

| Contrarian | CurrencyEUR | Date11/02/2026 | NAV1273.84 | YTD1.98 % | 1 year5.31 % | 3 years10.1 % | 5 years8.46 % | Download details |

| Defensive | CurrencyEUR | Date11/02/2026 | NAV210.28 | YTD1.76 % | 1 year1.9 % | 3 years3.73 % | 5 years2.44 % | Download details |

| Balanced | CurrencyEUR | Date11/02/2026 | NAV231.83 | YTD2.2 % | 1 year3.51 % | 3 years6.28 % | 5 years4.89 % | Download details |

| Dynamic | CurrencyEUR | Date11/02/2026 | NAV297.21 | YTD2.62 % | 1 year5.57 % | 3 years9.06 % | 5 years7.29 % | Download details |

Annualized return in %

Key features horizon

|

Flexibility

You are free to choose the frequency and size of the premiums paid.

|

|---|

|

Estate planning

You are free to appoint the beneficiaries of your smartlife policy in the event of death, a choice you can amend at any time free of charge.

|

|

You choose how you wish to access your funds

At retirement (between the ages of 60 and 75), you can opt for: a monthly lifetime annuity, free access to all or part of your capital, or a mix of the two. In the event of disability or serious illness, your interest or capital may be paid out before you reach retirement age.

|

|

Responsible management

The management of your savings is ensured by a team of experienced CapitalatWork managers. They aim to strike the right balance between risk and yields so as to profit from performance on the financial markets.

|

Pension reform in Luxembourg: What key changes are in store for 2026

Retirement planning in Luxembourg is a serious subject for everyone, whether you’re a resident or a cross-border worker…just like many countries, Luxembourg is facing demographic changes to its aging population. In order…

Read more : Pension reform in Luxembourg: What key changes are in store for 2026It’s more important than ever for young people to think about retirement planning

Why? Due to our increasing life expectancy many of us will have a much longer retirement period than previous generations. Living until you’re 90 now means you’ll be living on…

Read more : It’s more important than ever for young people to think about retirement planningInsurance premiums that can be deducted when you file your Luxembourg tax return

Luxembourg’s tax system offers ways to reduce your income tax liability thanks to deductible insurance premiums. Article 111bis of the individual tax allowances (ITA) (source: https://impotsdirects.public.lu/dam-assets/fr/legislation/LIR/LIR2025.pdf) allows you to deduct…

Read more : Insurance premiums that can be deducted when you file your Luxembourg tax returnFind all our advice on the blog

You can discover all our articles written by experts to help you understand the world of insurance, give you the best advice and above all, help you prevent risks in your everyday life.

The insurance check-up, the central instrument of our advisory approach

As an insurer, our role is to guide you towards the type of coverage most suited to your daily activities so that you feel fully protected.

To help everyone clarify their situation, we have developed what we call the “customer assessment“. It’s a simple, intuitive tool that provides an overview of your insurance needs, defines your priority requirements and your medium- and long-term prospects, and guides you towards a personalised solution.

To take advantage of this service, just make an appointment with a Foyer agent, it’s free and with no obligation.

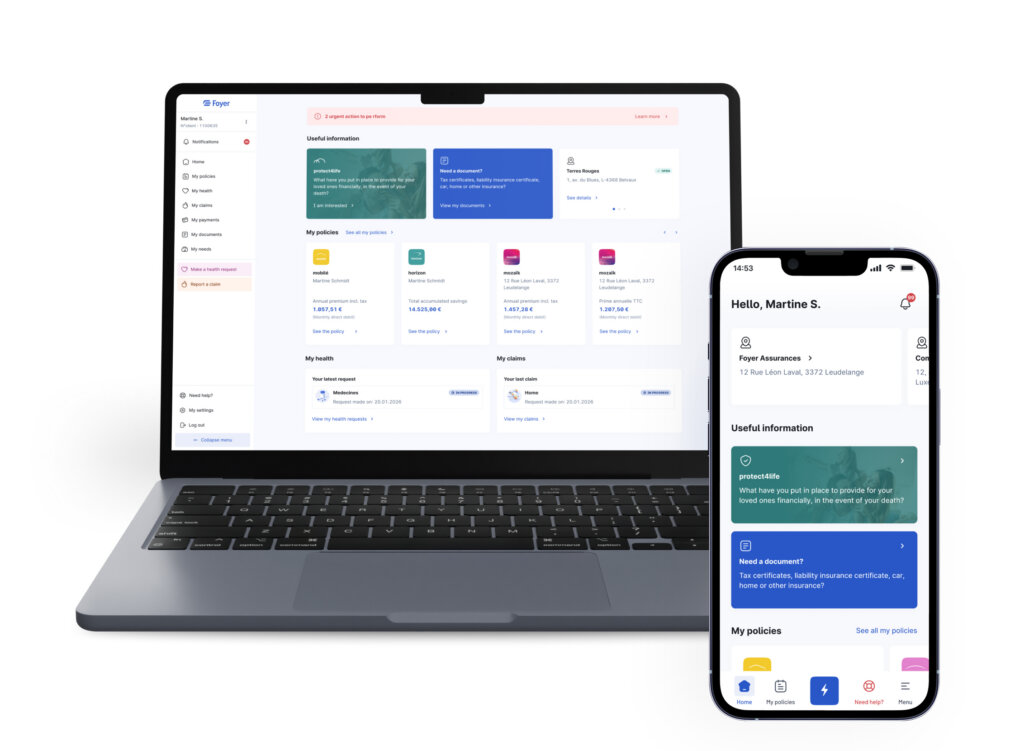

MYFOYER APP

Simple and intuitive, MyFoyer makes your online procedures easier

Submit your health and claims requests online

Save time and complete your procedures in your Client Area.

Sign your documents remotely

You can sign your contracts and direct debit authorisations from home.

Real-time tracking

No more waiting around, you can keep track of the progress of your files.

Access your documents

View and download all your important documents.

Manage your profile

Update your personal data yourself.

View and pay your invoices

View and pay your invoices online.

Contact me

Contact our experts and we will provide you with a quick response.